The Difficulties of Claiming Expenses Borne in Africa

October 18, 2011 Shem Radzikowski 3 Comments

When one works with (or within) large organizations, the process and logistics associated with claiming expenses incurred during normal work-related activities can be quite tedious. Logistics aside though, most of the problems are related to internal Accounts Payable (AP) audits which take far too long to resolve.

True, I travel more than the average person and many of my destinations are developing countries in Africa; not exactly prime holiday destinations for the masses. Nevertheless, some travel on AP’s behalf would probably be sufficient to end most of my (and my colleagues’) expense-related problems. I think it would be great if people could tear themselves away from the confines of their spread sheets and see how things work in the real world.

Of course, I realise that education of this sort isn’t always possible due to financial constraints or simply that people may not be inclined to holiday in the exotic developing world.

Accounts Payable List of Justifications

In the hope of retyping the same things over and over again to justify my unbelievably irregular expense claims, I’ve put together a quick cheat sheet.

So here goes, the Accounts Payable List of Justifications:

- Irrespective of today’s (or a particular day’s) exchange rate, in the most part, the hotel exchange rates are fixed and don’t tend to change with daily fluctuations in market rates, unless the fluctuations are of a substantial nature. For example, the Tanzanian Shilling vs USD has had its rate fixed for the past 8 months. And since most of my transactions occur within establishments connected to the hotels, the rate is the same even though the receipts may be branded differently.

- Typically, travel to the client/country is done on the weekend so that I can be onsite by Monday morning. Being a weekend, the banks are closed as are most money changers; this, once again, forces us to use the hotel exchange rate in order to have some working-cash available for the following days.

- Cash is pretty much the only way to settle bills in establishments outside the hotel because credit cards are not widely used.

- Invoices or receipts are rarely used or provided outside major hotels or larger restaurants. When they are provided, very few contain an itemised list or a company logo.

- At times the hotels will bill my credit card in USD (or another major currency) but will issue an invoice in the local currency — typically done in countries where inflation is high — in order to stabilize their income stream.

- Taxi drivers generally don’t give invoices. However, the cars associated with the hotel can issue a receipt but are usually twice or three times more expensive than a regular taxi. In order to minimize such expenses, I may at times write out the invoice myself on a blank piece of paper.

- It is next impossible to obtain most African currencies outside Africa ahead of departure These currencies are not considered to be “major” currencies and nobody carries them.

- It’s worth noting that it is necessary for me to first exchange my Home Country Currency (HCC) in my Home Country (HC) into USD and then into the African currency upon arrival. Changing directly from HCC to African currency is not possible in many African countries unless your HCC is either EUR, USD or GBP (unfortunately my HC uses none of these).

- Withdrawing money from ATM’s is not always possible because many banks don’t accept my Visa card (even though they are branded with the VISA logo).

- Interbank links are frequently down and even visa-friendly ATM’s may not be able to authorize a cash withdrawal, hence I’m forced to use the hotel exchange rates (however exorbitant).

- The telephone bill is larger than the allowable monthly limit because it is consists more than one months’ worth of usage. If you were to average the monthly usage over the billed period it would be much lower than the allowable monthly limit.

- The reason why I can’t provide you with a month by month bill is because either my internet banking is blocked when I’m in Africa or my credit card company blocks transactions originating from many African countries because of fraud triggers. I can’t afford to raise too many of these fraud triggers because my credit card company will simply block the card and the process to cancel and reissue can take up to a month. This will severely impact my ability to conduct business. Therefore I can only pay my bill when I’m back in my home country (sometimes every second month).

- It’s great that policy allows us to carry a corporate American Express card. Unfortunately AMEX is typically not accepted in Africa (with the exception of South Africa — but that’s another story) and therefore I can’t provide you with an itemized list of chronological transactions.

- When credit cards are processed electronically, typically, I can expect to see the transaction in my electronic internet banking portal within 7 days.

- When credit cards are processed manually (yes, the old-style voucher swipe machines) — typically used in situations where the bank links and/or power are out — the transactions will show up in my electronic internet banking portal within 30 days. Hence, it’s not always possible to prove the exchange rates or transactions within the same expense-claim period.

- If you’re contesting an expense claim for a mere $2.50, please understand that the effort spent in writing the mail in addition to me reading it has cost the company in excess of $15 (calculating roughly). I fail to see the logic in spending more money policing expenses than the amounts being claimed.

- The reason why I’m using an old exchange rate to claim my hotel expense is because when I checked into the hotel a pre-authorization locked the amount of cash at the date of check-in using a rate that was current on that date. Hence, it makes no sense to use the the exchange rate that was current at the date of my check-out.

Next time my claim triggers red flags, all I’ll have to do is quote a link to the abovementioned list of prebuilt excuses (err. justifications), with the hope that they will be enough to answer 99% of the most mundane queries and irregular claims (at least in AP’s eyes).

Related

Africa, Audit, Expenses, Finances, Work Africa, Business, Thoughts, Travel

3 Comments → “The Difficulties of Claiming Expenses Borne in Africa”

Leave a Reply

Subscribe

Subscribe and receive email notifications the moment Dr.Shem publishes a new post.

Our Sponsors

Recent Posts

- My Journey with Ropes: Scaling New Heights

- Climbing Mountains in and Around Pokhara: An Adventure Beyond the Summits

- A Nomad’s Notebook: Charting My Path Across Continents

- From Pierogi to Pavlova: My Transcontinental Childhood

- Riding Through History: A Personal Journey on the Irish Rail System

- Above the Azure: Discovering the Thrills of Paragliding in Malta

- Immersed in Nature: A First-hand Experience of Hiking in Wicklow

- My Emerald Isle: Why Ireland is the Epitome of Home

- Life in Boulder Colorado: A Quick Guide to Boulderites’ Lifestyle, Culture, and Values

- The Spirit of Ireland: A Brief History of Irish Whiskey

- Comparison of Firearm Purchase Procedures in California vs Texas

- First impressions on Austin, Texas and its Tech Scene

- Buying a Gun in California – Not as Easy as it Sounds

- Biometric Hype: A Risky Proposition for Fingerprint and Iris Scanners

- Temple Bar: A Great Place to Live, for the Deaf Insomniacs

- Zero Trust and The Mutating Threat Landscape

- CyberSecurity: Expanded Look at the APT Life Cycle and Mitigation

- Mentors: The Priceless Few and Lessons Learned

- Selected by Hackin9 and eForensics Magazines as a Contributing Cybersecurity Expert

- Notes from the Cloud Security Alliance (CSA) Congress EMEA 2015

- Analyzing the Power Consumption of Mobile Antivirus Software on Android Devices

- Poorly Configured Proxies Leaking Information through “X-Forwarded” and “Via” HTTP Request Headers

- CyberSecurity: A Case Study of the Need for Change

- Cyberconfusion: Cyber Security, Cyber-Security or Cybersecurity?

- CyberSecurity: Origins of the Advanced Persistent Threat (APT)

- A Newcomer’s Take on Dublin Town — First Impressions

- Crypto Wars and Messaging: How Secure are Skype and WhatsApp?

- Reduced Cognitive Performance: Open-Plan Offices, Noise and Collaboration

- First Impressions on Working with Huawei’s European Research Center (ERC)

- Lessons I’ve Learnt from various Relationships

- Money and Friends Don’t Always Mix

- X-Pyr 2014: My Annotated Version — An Assistant’s View of the Competition

- Malta Airport Gives Schengen a Slap in the Face

- Officially Selected for the X-Pyr 2014 Competition to Cross the Pyrenees by Paraglider

- A Scuba Diver Never Loses His Stripes

- I’ve Reached Middle Age, or so they say, welcome to the Fabulous Forty (40)

- Dubai Residency Visa: Medical & Blood Tests are a Waste of Time

- Pay-to-Volunteers: A Sad State of Affairs in Africa

- Malaria: Arguably the only African natural resource unwanted by the rest of the world

- Still No Conclusive Evidence Suggesting Syrian Government Used Chemical Weapons

- Will it take one million casualties in Syria before the West gets involved?

- Taking Advantage of Idiosyncrasies and Body Language during Business Meetings and Difficult Situations

- Dubai Holds Great Earning Potential for Anglophone East-Africans

- Absence Makes The Heart Grow Fonder — Does it Really?

- Five Thousand Eight Hundred and Sixty-Two Kilometres from Home

- Avoiding Chronic Short-term Memory Loss on Large Projects

- Invited to Talk about Achieving Enjoyment at Work

- Shove your Hello Tomorrow and give me my Quiet Today

- Professional Certifications: Why get certified in the first place?

- Critique of Media Coverage on BlackBerry’s Share Price Free-fall

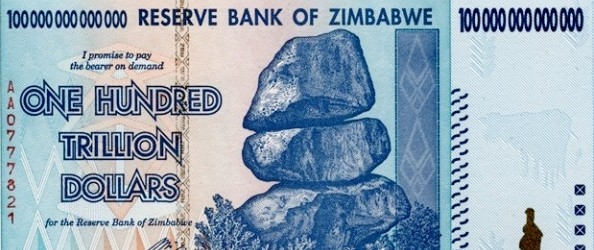

so what can you get for one hundred trillion dollars?

Back in the day when the Zimbabwean inflation was at its highest, you could get about two loaves of bread for that. Just before the collapse of the economy and the Zim dollar, you could get one loaf for about 400 trillion.

Man, you should forward this to our approving managers and finance controllers.